Through a truly unique perspective, Davidson takes us back through time to examine the fundamentals of human need and the earliest human disruptions.

Disruption is nothing new, it is as old as we are. As soon as human beings evolved from primates to homosapiens, and realized they needed shelter from the elements, to eat, to breathe, to protect each other, they have been disrupting themselves ever since.

Disruption was based on the needs of the humans at that time but today, humans are the same….how do we measure ourselves? By what we’re building.

VIEW PRESENTATION:

VIDEO TRANSCRIPT:

It's a pleasure to be here. My name is Michael Davidson, I am with JP Morgan Chase and have been for nine years and I lead JP Morgan's global corporate real estate portfolio across Asia, EMEA, Latin America, and North America. So today we're going to talk about corporate real estate and disruption. But before we get to your 2019 I want to go back in time, all the way back in time because this notion of disruption is nothing new disruption is as old as we are the universe the earth by the way was created a pretty big disruption.

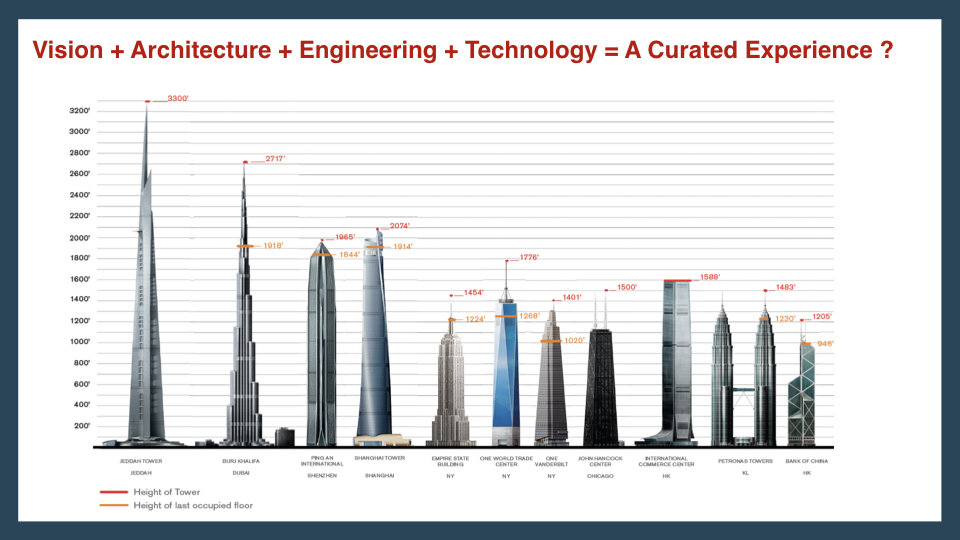

As soon as human beings evolved from primates to homo sapiens and realized that they needed shelter from the elements and to eat and to breed and protect one another, they've been disrupting themselves ever since. In 2019 and going forward is just the latest incarnation in our lifetime. In the ancient world the Great Pyramid of Giza or the lighthouse and Alexandria. In the modern ancient world you had the Taj Mahal or Machu Picchu by the way if you look at the wonders of the world and one of the great benchmarks for how humans rate themselves in terms of their progress it's all stuff that we built with technology stones and architecture and thought and one of the things that makes that common to what we're doing today is that all of the great wonders of the world had a purpose and they were tethered to a culture and they were based on the needs of human beings in that society at that moment in time.

Now let's go to 2019 and we have the benefit of having experienced the 20th century and now the 21st century humans are the same. How do we measure ourselves by what we're building? Only now we have steel and glass and we build towers and we go as high as we can possibly build them. We impress ourselves with these monuments and they are monumental. If you go to any city around the world, what are you impressed by first the skyline. When you go to the souvenir shop what do they have, little statues of buildings that were built that you think of a city you think of the Eiffel Tower you think of the Space Needle in Seattle you think of the Colosseum in Rome you think about what we built.

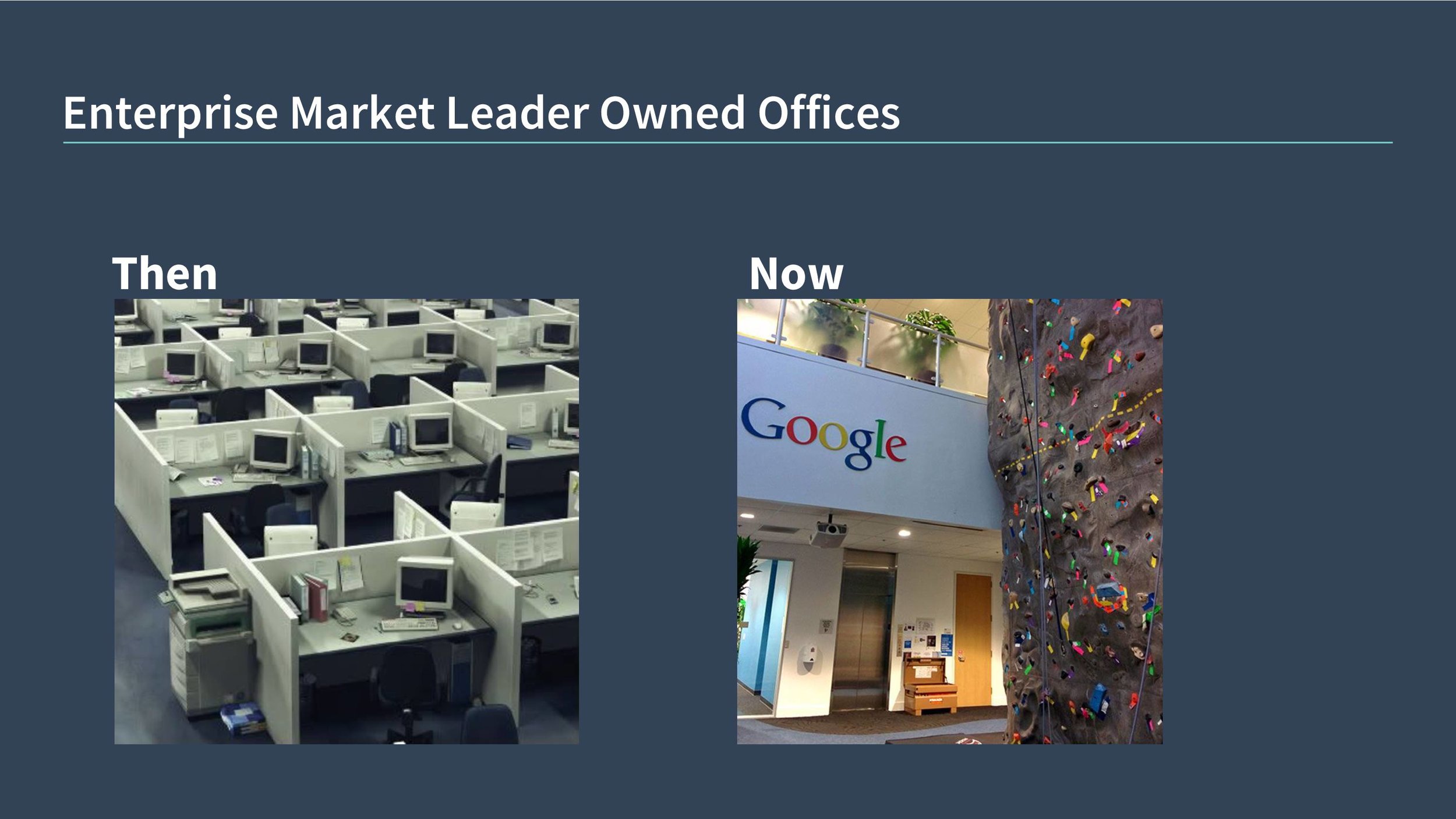

So if you look at this your vision and architecture and engineering and technology. But is it a curated experience? Like what's it like to live inside of these structures. It's great to look at,from afar. It's great at night when they're lit up but if you're one of the three or four or five or six or seven or ten thousand people that go and work in these buildings every day. What's that experience like. Is it is nice is looking at it from afar. JP Morgan is on the cusp of doing it once again.

We are taking down to 70 Park Avenue which was in the Times last year to build a new tower one that is thoughtful one that has core and shell and look and feel and all of the pedigree that you would imagine with a 21st century office tower. We are going through this exercise now but the fundamentals are very much the same, which we'll get to.

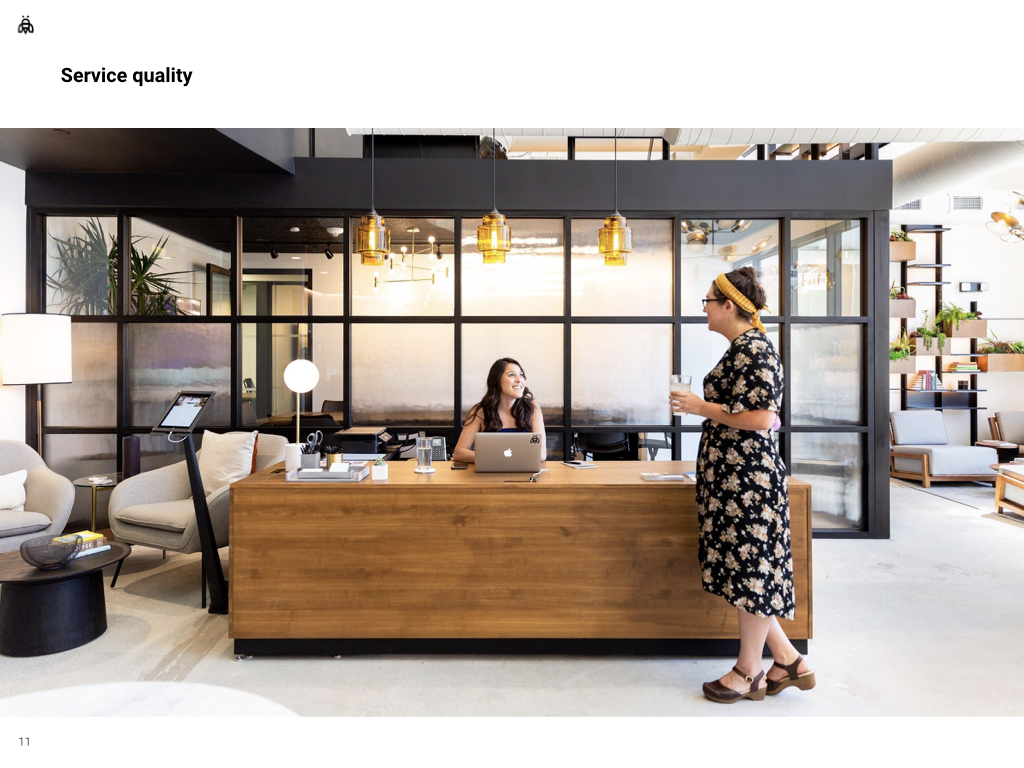

We've built spaces year after year after year and we've hired the best architects and the best thinkers and the best amenities experts and we've engaged H.R. and we've tracked our headcount and we've created spaces spaces that are modern that bring people together to eat to think to learn to collaborate that don't feel like a bank. It feels like a place you'd want to sit and talk to someone.

All of these are examples of spaces there's no need to call out where they're built. It's fairly ubiquitous in terms of how we approach our real estate globally also because our employees are global so that what you build in Singapore or New York or Dallas or San Francisco people travel and if you're not building like for like and you're not consistent they'll call you out on it.

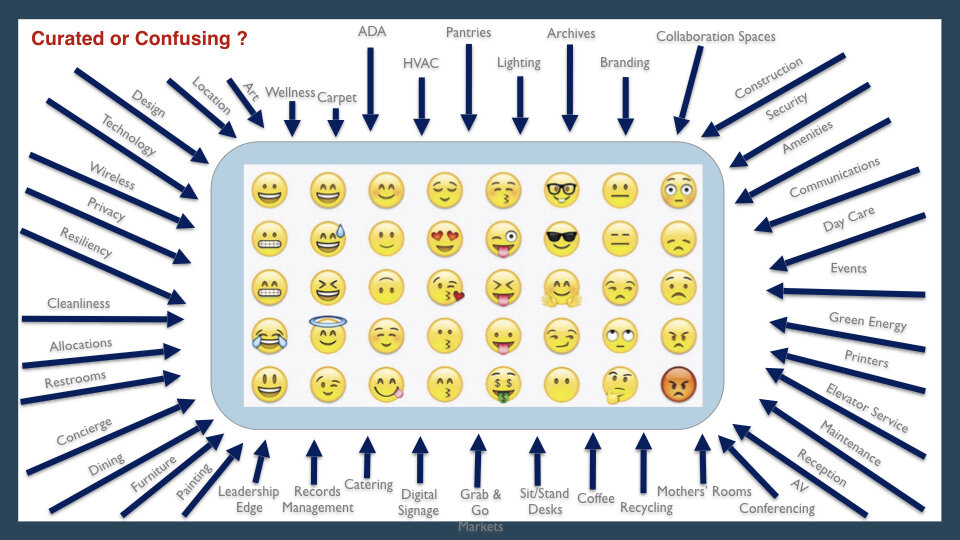

We're very consistent in terms of our design palette. Now, if you're an occupant and one of our spaces or in any space anywhere and if you really add up and account for all of the things that define your experience as an occupant, coming to work every day. What's your experience like? all of the things we could have named more but we ran out of space on the slide but we think we made the point is it curated or confusing. One of the things that happens is that although we lead real estate we don't lead all the things that impact your experience.

We don't lead security, that's among your first experiences whether you can get into the building does your card work. We don't run amenities, food pantries, technology, wellness centers we integrate them in real estate but we don't run these functions. So through the years occupants and different companies occupying remarkable structures probably felt like they're looking at oncoming traffic rather than like in a curated workplace experience. Because all of these things were happening if they were synchronized, it was almost luck or it was because people were really good partners within a firm. But this is often what happens and what happens on the inside.

I can tell you that every one of these emojis in my 25 year career I have experienced every one of those emojis and many more in the occupants that I've served. You get the entire spectrum depending on what people's needs are how they feel how you're delivering it and how you're integrating the myriad of things that actually impact a person's day or a moment in the spaces you create.

One of the things that happens or is happening in the 21st century is that one of the solutions as well is just fill the space with technology to really disrupt ii and if we load the space with technology well people will love it. They'll be connected and they can use their devices and they won't need to get together as much. So there are two problems with this. One problem is that when technology is installed people don't often know how to use it. How many conference calls or telepresence on Cisco have I been in meetings internally and externally where you have eight smart people around a table saying how do you like dial n. It should be intuitive but it's not always intuitive. Is there a wireless signal. Oh wait. I'm from an outside company my laptop doesn't work. Sometimes the technology is not as intuitive as it should be.

The second thing that we're learning and we're learning this much more slowly, not just at a corporate level but at a societal level is that we're more connected than ever and yet we're lonely. Why I'm connected to my friends all over the world via social media. They can say hello to me and share pictures. Why are kids lonely. Why do we get notices from colleges and universities that say that anxiety and depression are on the rise? because there's a fundamental human need for connection and it isn't via wires or screens it's in person, something that's never changed all the way back to the ancient times to now is that people need each other.

When our businesses come to us now to develop new spaces it's interesting that among the first things they say to us after technology is we need spaces to get together in person to innovate. Innovation Labs collaboration spaces smart rooms where we can physically come together even though we can do it with technology remotely we need a room where we can physically be present. That's where the innovation actually happens.

So you have to be aware that you don't try to solve the previous slide all of the different inputs by saying well let's just kick it out with technology and it'll be fine, It won't be fine. So let's go all the way back in time again and let's talk about fundamentals, fundamentals that were true in the ancient times and every century sense. These are the things that within JP Morgan we are evangelizing over and over again is how we treat one another.

Is that one of the primal parts of the experience that we have no matter how nice your workplace, how beautiful building it is, how far into the sky you are sitting, because we were able to build it that high, is that if you're not treated with dignity and respect by the people you are spending time with, your experience will not be good; if it's not fair. If these are not exercise if there is not empathy and accountability integrity and respect and diversity and trust, well no matter what space you're in wherever you are in the world you're not going to have a great experience.

So corporate real estate, we are disrupting it and it. It’s being disrupted but just like every other object in space has been built by mankind since the beginning of time, if you disrupt corporate real estate without purpose, purpose equals plan equals strategy equals thought,without values without culture without humanity and honoring and genuflecting to the inherent human needs for the people that are going to occupy your space, well then your disruption is just going to be disrupting and nothing else.

If you use these as pillars, if you build your disruption upon these pillars as a grounding well then what happens is that the disruption becomes a transformation and why is it a transformation? Because you're creating an experience that attracts and retains people. So when you attract and retain people this is arithmetic. If you attract and retain them that means they start to build relationships and when they start to build relationships they start to trust each other and hang out more and when they do that they talk more and when they talk more they start to share ideas and open up with each other.

Then they start to innovate and then the real disruption starts to happen. The constructive disruption the moving forward progressive disruption that impacts the person the team the organization the industry and even society itself.

Thank you very much.