How does capital investment in real estate improve profitability?Coming from a background in finance, Todd challenges the audience to think about presenting business cases for workplace change to a CFO or COO. What are the inputs and outputs? What is the present value? How do we present information that allows you to make decisions about workplace productivity and drive the bottom line. Can we tangibly track and display results to make that business case?

VIEW PRESENTATION:

VIDEO TRANSCRIPT:

My name is Steven Todd, I'm Global Head of Workplace at NASDAQ and I'm also the founder of Open Sourced Workplace. So what I want to talk to you about today is I want to challenge you. I want you to think about workplace in a different way. I want you to think about workplace and how you would present a business case to a CFO or CEO. So in essence think about what you would need and how you would present that information and then we're going to get to optimize and productivity.

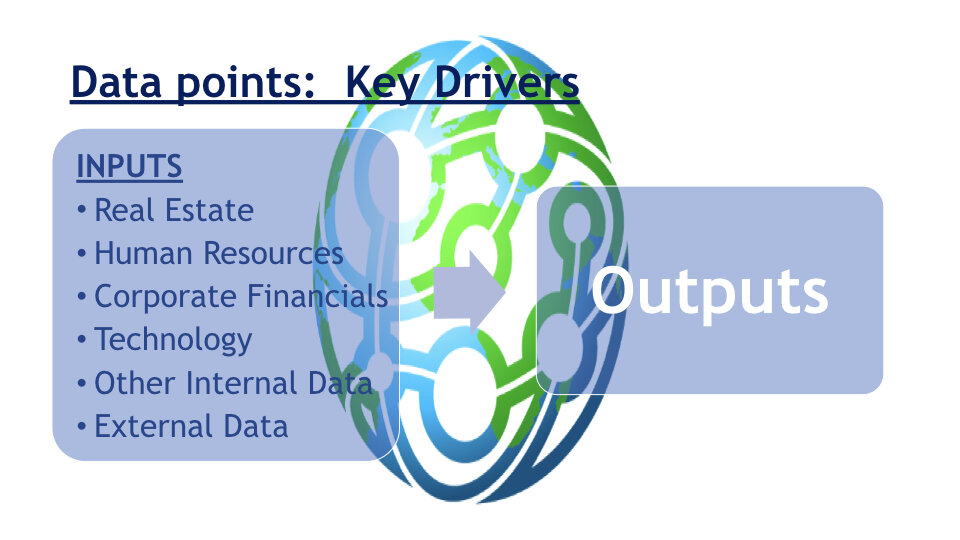

So the way I sort of position is that I'm a finance background, I spent 15 years working in finance, everything we did we did an investment appraisal every time we did a business case. That was what were the inputs and what's the output of a CEO or CFO or interested in is what is that profitability? Is it gone back to what was said before what is a net present value? Is a positive as a negative? If it's a positive okay let's go and do it. So how would you then position that if you wanted to think about workplace. What are the attributes. what are the inputs that drive the outputs? When we consider workplace and how do we sort of position how do we think about that?

So in 2014 when I got into real estate these are the questions that were going through my head. How do we actually get together. How do we present information that allows people to be able to make those decisions? And these are some of the questions that sort of were flowing through my head. What makes employees productive. What features of an office actually drive the bottom line? We all have a perception that given everyone great coffee drives productivity but actually can we tangibly track that to actually display that actually helps the profitability of an organization.

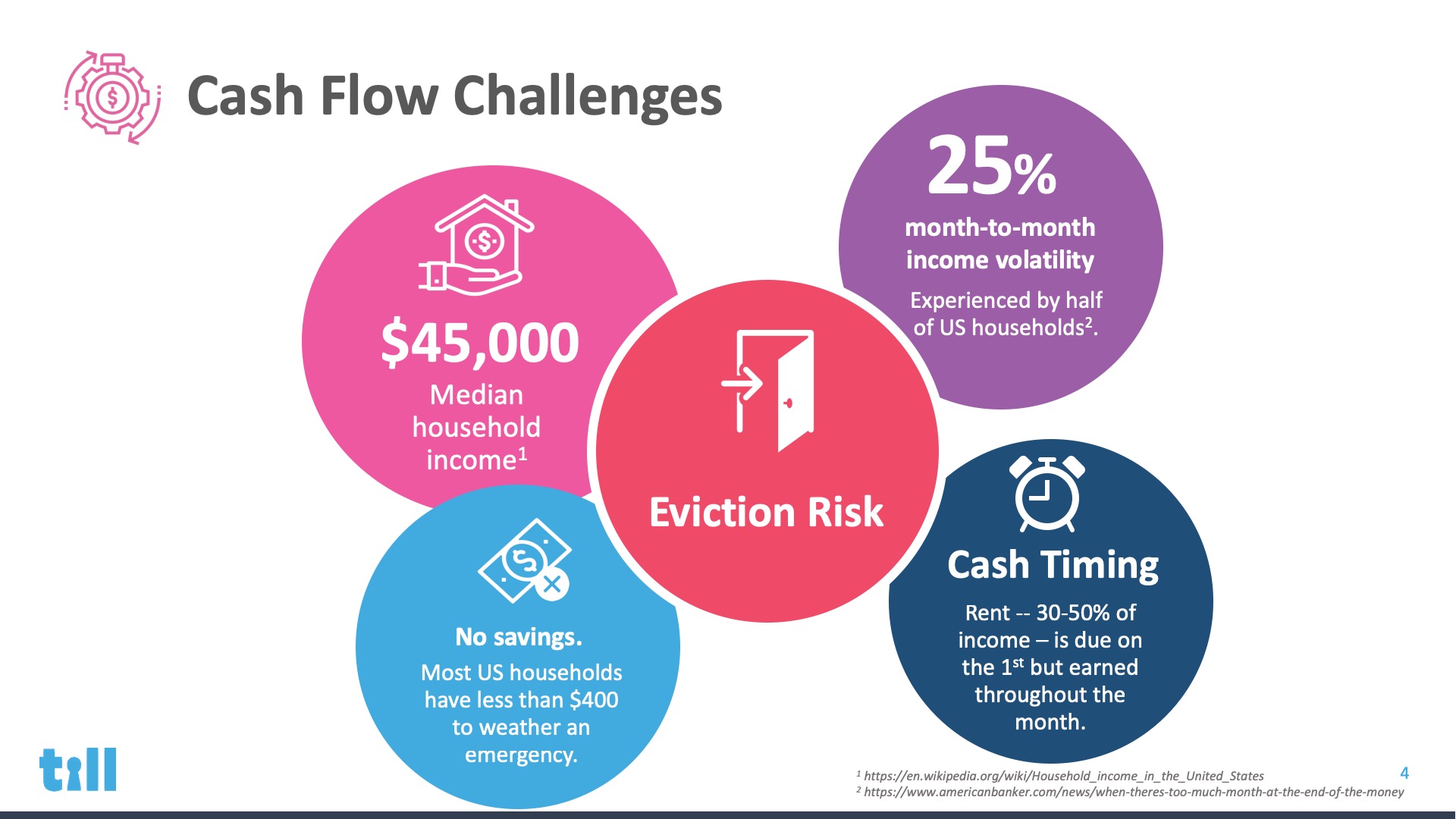

Do employee engagement scores actually move the bottom line. We aspire to improve them every year but actually does it really materially make a difference. Anecdotally we think it does but we don't have any scientific proof behind it. How does capital investment in real estate improve profitability. So whenever we're presenting a business case how do we actually know that we're going to drive profitability. Real estate is an expense sucker right you have to pay for that through layers letter. You hope you gain benefits from it so how do we put that narrative ahead of time and how do we work that idea and does an employee compute impact profitability and this is just the way my brain works.

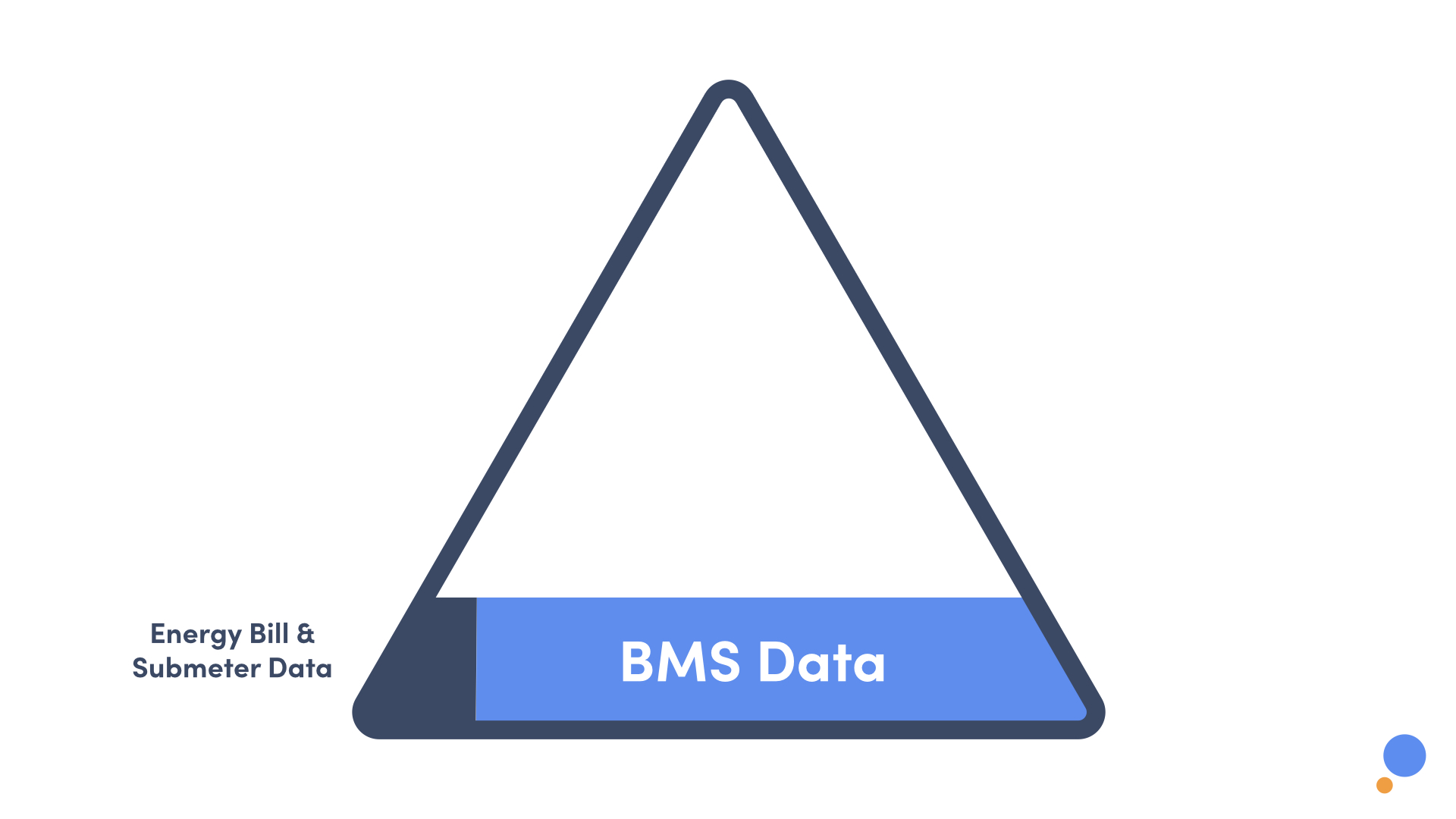

I just think along those different lines is it actually a benefit or is it does actually hurt if employees have to travel further. So that's sort of where some of this where this lays. So as I thought about this how do you even start to think about getting the data to answer some of these questions. And so again go through that concept inputs and outputs right. So what are the inputs that we could collect that actually would help us address some of that information. So yes we've got the usual suspects of real estate and human resources but again bringing in that corporate financial information where's the sales revenue coming from per location.

What is the expense associated with every single office across the organization. What is the product profitability of every product that we produce as an organization on what location are they associated with. Whenever you marry that with real estate with employee turnover with other aspects of some of the other data points then you can sort of start to see pictures evolving and actually the conclusions may be able to get to.

So what are the marketing KPI is what are the seals KPI is how can we bring that together into one data set to help funnel some outputs and some conversations and external data. So where is the access to talent in all the locations that we operate in right. How many if you've got sales associate. Does it actually impact them for the actual amount of people they're connected to on LinkedIn. Is there a direct correlation. I don't know but again these are some of the ways that our brains are sort of working and obviously the whole point of this is to drive outputs.

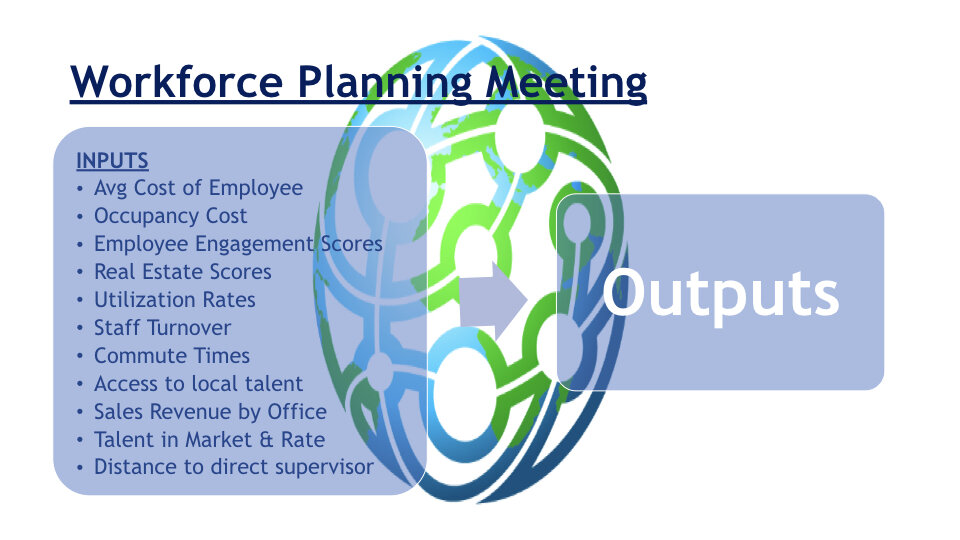

So to try and picture this a little bit more I put together a little scenario. So you know you're a sales manager you've just got given this initiative we've built these new widgets you got to go and sell it. So how do we sort of package these datasets to help the sales manager one pick the right location where he wants to put all these people and how does he present that business case again thinking about the CFO and the CEO or he wants to present or she wants to present that information. So what if we were able to pull all this information together? What is the average cost of employees of every word that we operate.

What is the occupancy cost associated with all those various locations? What are employee engagement scores? What is the real estate score for all those various locations, what are the utilization rates the staff turnover, the commute time, access to local talent, what actually is the cost of that local talent that we want to grow? What is the sales revenue by office? As I said are the distance to direct supervisor so how many time zones away is your direct supervisor how does that impact the sales potential of whatever office.

So can you imagine a sales manager sitting down with their eight hour business partner and this is all the information they have at hand. How much smarter and how much better decisions can their sales manager actually make when he then goes to take or she goes to take the business case to the CEO or the CFO. It's a lot more substantial that there's a lot of data behind it. Year two whenever they come back to evaluate they think back and track an index against okay these are the reasons why we made the decision was the outcome as expected.

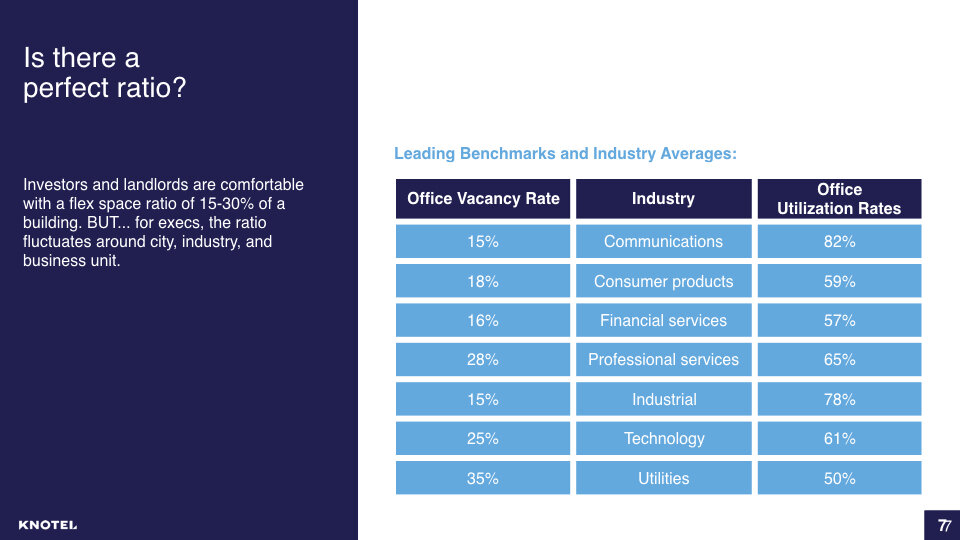

So when we go through when we collect this data we always aspire to get more data and part of that. One of the things we have to do is always ask ourselves what is the ROI of this data. What is the cost to actually get it and if we get the information will it actually make a difference to the decision. So today you know we talk about how we can actually look at security badge data and we get utilization rates. Well then if you have that and utilization rates and we all know is usually around 60 percent. If the management isn't going to make a decision or change the decision on that information why pay for it.

Asking for a Desk Utilization Study because they are hardly gonna change their mind later. Is this how you evaluate what actually should be taken?

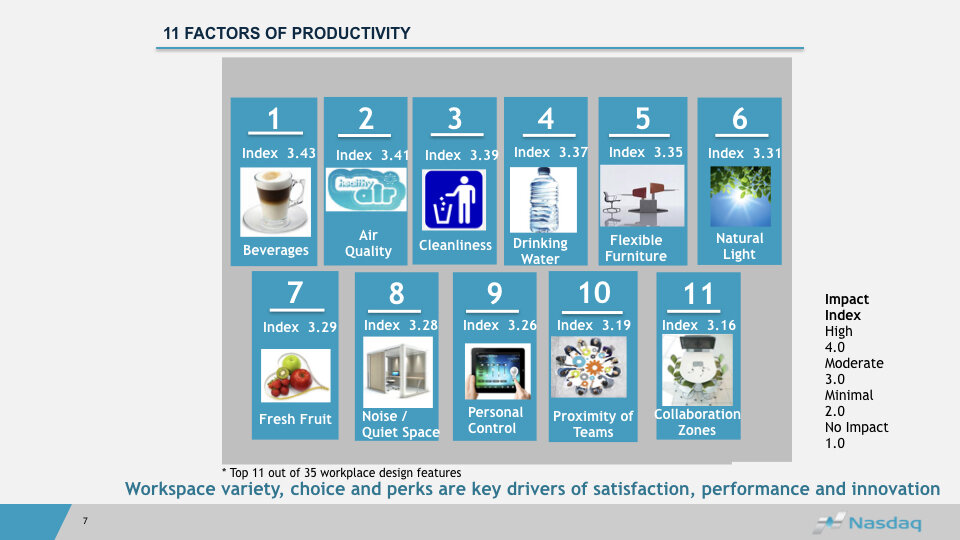

So part of this is we go back to the last question are there sort of one of those questions we had up on the board, how do we actually engage with the CEO and CFO to actually allow them to make decisions and how do we present information to them to make decisions. And one of the things we did at Nasdaq was we try to tackle the question up there, what is workplace productivity what is employees productivity and what does that look like. We actually went out to our employees and we asked them.

We provided 35 attributes of an office and asked them which of these attributes makes you productive. And over half our employees responded and this is what we ended up with. So this is our true north in everything that we do and how we look at and evaluate what we have to do in real estate. When we're designing a new office, this is where we go. This information, we can look at it by every location.

The actual productivity factors change by location, so whenever we actually assess what we need to do we go back to this, the attributes, and we look and those are what we benchmark against and we put that forward.

So we have these attributes, each year we ask the employees how do we rate against each of these attributes and what is the opportunity we have to improve an employee experience at every single office. It also helps us whenever we come to make those capital investment decisions we're able to display this information we're able to display the feedback we get from employees. And here's the investment we want to make. And we're now in a cycle where actually we are able to go back and validate actually here's where we invested the money and this is the impact it actually had on the employee experience and how they're rated their real estate portfolio.

So as I said my background finance I come at this at a slightly different way and my brain's a little complicated. Yes it is. But in essence that's how I try to look at this stuff and I sort of want to challenge the team and I sort of hope you've taken a little bit away from what we've said and how you sort of present data and information to the CEOs and CFO. So thank you