Vik Aggarwal, Global Head of Enterprise for Knotel discusses diversification of commercial real estate portfolio strategy. What you need to know about flexible office space, hybrid real estate model & more.

VIEW PRESENTATION:

VIDEO TRANSCRIPT:

We are going to talk a little bit about Knotel but this is not a sales pitch. This is about how we approach portfolio strategy. So, for those that don't know me my name is Vik Agarwal, I run enterprise for Knotel.

I’ve been here for about seven months, prior to that I was number two for global real estate for AECOM out in L.A.. Prior to that I ran global real estate strategy for American Express. and prior to that I had CFO role and portfolio strategy roles at BlackRock, Morgan Stanley and J.P. Morgan Chase. So what we're going to talk about today is how you diversify your real estate portfolio.

A lot of that comes down to using flexibility. Harvard Business Review put a quote out about how important flexibility is to a portfolio. Now this is nothing new for any corporate real estate executive, we've been trying to do this forever. Take a traditional lease you know, talk to the landlord, get me my termination rights sure for our expansion rights all these different things but they will come at a cost. And still you exercise a termination clause you're going to pay on unamortized TI’s, you're gonna pay unamortized commissions, you have asset write off. It's a huge financial pain that you take on the P&L cash flow and balance sheet.

So yeah there are some advantages to taking a direct lease. Some of these are long term stability, you have more control of the space of a direct ownership relationship. You have the ability to advertise your assets that you own over a period of a longer period of time and you can really control your privacy your I.T. your security as you enter the space. Now flexible workspace is something that's new and it's a new tool that's in people's tool belts.

Now Knotel is not and why use flexible workspaces that we are not coworking. So a company that does enterprise grade does not want two seats, three seats sitting next to random strangers. They need to have their privacy. Some of their employees maybe we're using P.I. data, social security numbers, you know this is a lot of intangible risk and tangible risk around having a transient crowd working with your employees.

As you think about flexible workplace there's a lot of different ways to use flexible. Your company may have gone through an M&A and maybe divesting a company, it may need swing space, a line of business may need to work differently. Your CEO may have said I need three hundred seats tomorrow and that becomes your oh shit moment right. That you need to go and solve and you've got to be the superhero. So the benefits of flexible is that you don't have to do occupancy. So U.S. gap as you a straight line your rent as soon as you take possession of the keys which is a drag on earnings; CFO’s don't like that, that goes away.

You don't have disposition costs in the future. So say your headcount balloons say it reduces by 50 percent, you don't have to go worry about disposition of the space and sub leasing it. You don't spend capital? you are basically converting capital to opp X so that frees up your free cash flow for a company that allows them to go buy things with their cash and use their balance sheet for some things more creative to earnings. If you can have a fully serviced office experience which has IT, design workplace strategy, you don't have to give up some of the stuff I said in the traditional lease about the IT you get find the right provider, they can even hand you the fiber optic wire and walk away.

Everyone's headcount fluctuates. There is a Boston consulting analysis that says 41 percent of the companies interviewed said their headcount projections were wrong by 100 percent. This is not new to anyone right, so if you think about that that's a huge drain. Real estate is the second largest expense for a company so getting it wrong has huge financial consequences.

So why go long in space when the word future inherently means uncertainty and you have the ability to have a fully tailored office that matches your space standards and branding experience, use a certain type of stand desks across the world we can match that. You know Michael talked about whether you go to Portugal or London or D.C. or LA they want to have the same experience as people travel. You can still have that when you work with a flexible office provider that is global in scale.

There's a mix between this now too.

So some companies are saying you know what I know what my base headcount is going to be is never gonna change but I do when projects and I do lose projects. So I need the capability to fluctuate up and down based on future needs, so that's what I call the hybrid model. The hybrid model is basically that you can add flexibility to transaction level. So a company like Knotel and this is something we've actually done in London is a company who said that they wanted space and go long, but they want to be in the whole building but they don't want to have the whole building today.

So what do you do, you reach out to a flexible service provider like ourselves. We took down the rest of the building and they took a floor day one so they can contract down. Then they also have call options, first refusals to go long in that space is adding true flexibility at the transaction level and choose scalability. So you're not bifurcating that a second third fourth building or have future disposition risk.

One of the concepts I want to talk about and this is a metric that every company uses which is net present value to determine what's the best way to make a decision. Building A verse Building B, Time Value of Money. Time Value of Money tell us your dollar today is worth more than your dollar tomorrow. But there's a flaw. It doesn't tell you whether the decision was right day2. It doesn't tell you whether you're spending good money after bad money. So there's a reverse concept of that called the money value of time. So if there is a way to create a structure where you're spending a few percent more to not have to make a decision that's valuable.

What keeps people up at night, I went too long in space, I went too short in space, my CFO doesn't want to spend the capital of a fully depreciated asset, I don't want to have dual occupancy have a bubble period. All these things that show you as a real estate professionals like this a no brainer we should be doing it. These keep other people up at night as disposition risk, asset write offs. If you have a capability to scale up your headcount or scale down the headcount because you're flexible workplace you're not spending capital we don't do occupancy that really transforms the scalability and your ability to do portfolio optimization on a real time basis.

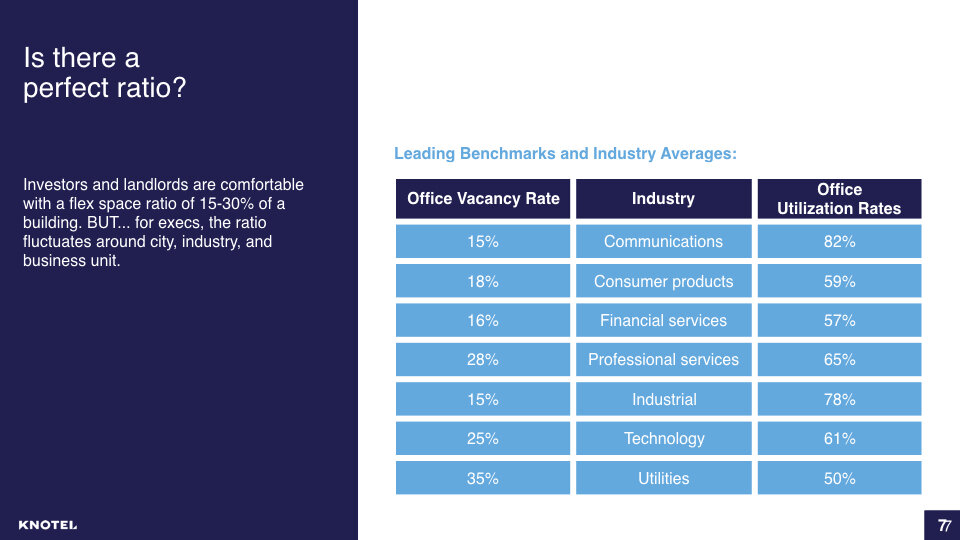

You've heard a lot about what exposure a landlord wants to have in a building. People talk 15, 20 percent of that space should be flexible. But for a corporate real estate executive, what is the right mix. People want to have metrics. Everyone has KPI’s. Well, every business is different. So you have office vacancy rates that are different by market and by industry and most companies say you know what I want to have 10 percent vacancy so I want to restock the whole building.

But then you have on top of that not everyone comes to the office every day. Yes you solve that through heads to seats ratios. You look at badge swipe data but the truth of the matter is people travel. People take vacations, people take holidays, things happen.

The short answer to that right is that there's really no answer to that. You really have to look at your business and say by market, by business unit what is the right metric that I want to have. And you start implementing that based off of that. Flexibility is the most important thing that company can add to the portfolio because it really allows them to have scalability upwards and downwards for their second largest expense for the company